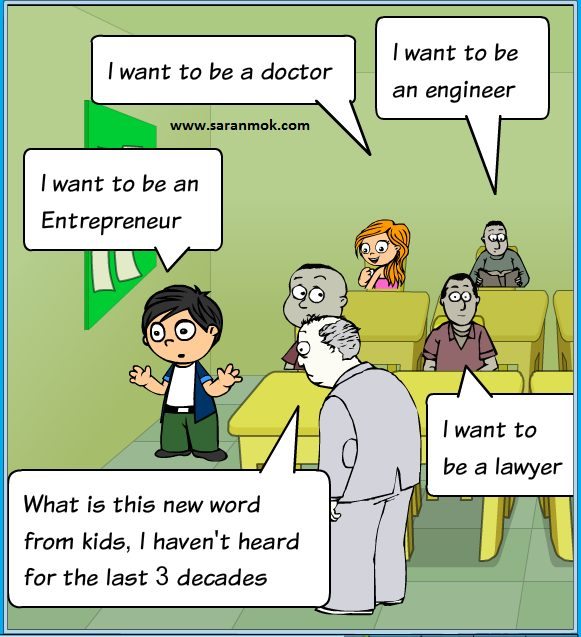

How to become an entrepreneur:

Before knowing how to become an entrepreneur we need to understand to do list to quit the job. Entrepreneurship is a journey with a lot of uncertainty it is like bull riding Consequently we need to be prepared enough.Here is the to-do list before quitting the job.

You need to get the bull into your control to ride. In the process of taking into your hands, the bull will kick you down, grab you, take hold of you. Be brave and get into battle, the brave heart’s only can win the battle and take the bull by hand. Imagine the confidence when you control and start riding the bull, it can never match with any other happiness. However, here is a to-do list before quitting a job to turn as an entrepreneur.

Keep your lifestyle reasonable:

The majority of people are spending more than 90% of their salary and 10% for savings. To my knowledge, if you get 100 bucks per month I would advise you to spend 60 bucks and save rest of 40. I know how difficult it is. However, if you implement it from the day one of your careers, it creates the good fund. Apparently, I don’t ask you to suppress your happiness, treat the 60 bucks is your capability, if you want to buy something beyond that capability, then you need to earn more. If not, you may have to work until the last breath, Let me tell you my concept

Below theory helps How to become an entrepreneur.

Every person is a frog in their pond, and every frog compares with other frogs in that pond. Essentially, it applies from world’s rich person to poor person. If we minimize this comparison, I believe you can avoid buying unnecessary things, and it saves you a lot, This is the first thing in to do list before quitting the job.

Sometimes the frog may get into another richer pond (which is little rich society) eventually, habits mindset and lifestyle would change based on the new frogs.

Frog: You or me.

Pond: Society (it changes based on your earning).

Apply the frog story in our life, however, don’t forget 60:40 ratio about financials.

Make a financial plan for next 24 months:

To my knowledge, a plan with a lot of uncertainty, unpredictability, and assumptions is financial plan 🙂 it applies from an individual’s to a country’s budget. Consequently, realize that a plan which helps to replan the plan is a financial plan 🙂 If you see any typical financial report which contains columns.

Projected, Allocated, Planned, Actual, Planned vs actual, etc…Depends on the width of the paper 🙂 so if we can predict very much accurate why do we need these many columns in the report? Honestly speaking many things are not in our control, we usually work hard to make the plan workable.

As entrepreneurship is with lot uncertainty, please plan your financials for next 24 months to lead a minimum sustainable life with 30% of the buffer.

Avoid long term commitments:

What is long term commitment? I would say more than 5 years of financial commitment is long term commitment. EMI (Easy Monthly Installment) is another big addiction which would lead you to de-grow. I would suggest, avoid EMIs or finish before turning into an entrepreneur or freelancer.

Taking an EMI is not wrong as long as it doesn’t rule your life. I would suggest, don’t go for long term commitments as it ruins your financial freedom. However, keep your option open for housing loan rather than any other loans. Since the home is an asset which is worth to dare for a limited period. One more must follow action item to do list before quitting the job.

If you buy things you don’t need, soon you will have to sell thing you need

Warren Buffet.

Own minimum amenities to survive:

If possible plan to own minimum amenities with no loans. Home, Car, bike, home appliances, etc. If you don’t own them, you may end up paying rent for these things can’t be avoided to live. If you want to know How to become an entrepreneur, you should be aware how to lead a life with minimum amenities.

Start avoiding Credit cards:

Pretty common psychology of many people is: Paying with credit card is something which is not from my pocket now, maybe sometime later. However, we don’t realize that it is not so far, just matter of next pay cheque. Consequently, careful while using a credit card when your next pay cheque is uncertain. The credit card is a beautiful weapon as long as you know how to use it wisely. Otherwise, it can be your first financial enemy.

Obtain good health insurance:

Being an employee, you may not realize the value of health insurance. It protects you and your family a lot without getting ruin of your wealth. Life is not predictable, so I would advise you get a right insurance plan it is the most important one in to do list before quitting the job.

How to become an entrepreneur and to do list before leaving the job.

Are you a brave heart? Come on ride the bull.

Also Read: Checklist of 10 points how to be an entrepreneur

He is the Author, Product Specialist, Business Consultant, Entrepreneur, Public Speaker, Thought provoking writer, and Joke writer. Follow him on Twitter

Leave a Reply